CA EDD DE 3HW 2010-2024 free printable template

Get, Create, Make and Sign

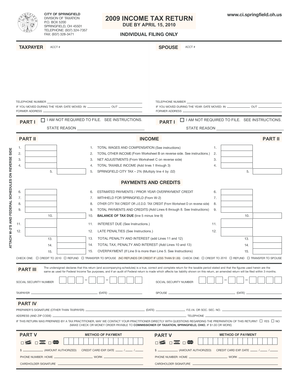

Editing gross income online

How to fill out gross income form

How to fill out gross income:

Who needs gross income:

Video instructions and help with filling out and completing gross income

Instructions and Help about de3hw form

This is part of QC step comm and in this video I will walk you through the new hire paperwork my name is Cory Finnegan, and I am a transition specialist with the step program the new hire process and the paperwork can be confusing especially with your first job, but the paperwork is actually pretty simple and in this video I hope to explain it clearly so that you don't find it to be intimidating when you are filling it out so let's start off with the i-9 form this is a form that everyone that is working in the US must fill out it verifies that you're eligible to work in the United States there are many ways to show that you're eligible to work the most common documents are a US passport a driver's license a state ID a social security card your birth certificate school records and your school report card there is a sheet that shows all the documents that you can use, and it looks like this my goal is to keep this simple if you have a passport then that's all you will need to verify that you're eligible to work if you don't have a passport you can use a driver's license a state ID or if you're under 18 you can use a school report card or your school records if you use any of these things you'll also need to show your birth certificate or your social security card like most government documents the i-9 can be a little overwhelming when you first look at it, but it's really not that difficult to fill out all you're going to need to fill out is the part here that is highlighted as you can see you'll need to print your last name first name and middle initial if you have a maiden name put that in there you fill out your address your date of birth and your social security number there are three boxes under that, and you'll need to check one of these if you're a citizen or national of the United States you'll check that first box then you sign and date that's all there is to this document the rest will be filled out by your employer again it looks like a lot when you first look at it but as you can see it's pretty basic the next form you'll need to fill out is the federal w-4 form this is the form that lets your employer know how much money they need to withhold from your income for your federal income tax there are two sections that you'll need to fill out it looks confusing, but it's pretty simple to the first part is the personal allowances' worksheet before you fill this out you'll want to talk with your parents or guardians to find out if they claim you on their taxes if they do this part is real simple you put a zero on line H, and you're done if your parents or guardians don't claim you on their taxes you will put a number one on line a and a 1 on line H that is what you would normally do and if you have any different circumstances or questions speak with your parents or guardians let's move down to the bottom of the document you fill in your first name and middle initial your last name social security number and address then you'll check the...

Fill ca de 3hw form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your gross income form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.